BRITAIN’S ULTRA-RICH MAP OUT ROUTES TO ESCAPE ‘NON-DOM’ TAXES AFTER LABOUR VICTORY

(Bloomberg) -- Over the years, Bassim Haidar has acquired all the typical trappings of Britain’s super-rich: a Gulfstream jet, luxury yachts and mansions with Middle East royalty as neighbors.

He now also has something the wealthy elite living in Britain is increasingly coveting: an exit plan.

The Nigerian-Lebanese entrepreneur is one of many well-heeled UK residents currently firming up arrangements to leave the country. The reason: A recent proposal by lawmakers to scrap preferential tax treatment for non-domiciled residents — rich foreigners living in the UK, also known as “non-doms.”

Keir Starmer’s Labour Party — which won the July 4 vote in a landslide — more crucially said in its campaign manifesto last month that it would go further than rival Conservatives and eliminate inheritance tax breaks on assets that non-doms hold in overseas trusts. The threat of having to pay significantly higher levies through living in Britain is now prompting many to consider fleeing the country.

“I decided to come and live personally in the UK — not my businesses,” said Haidar, 53, founder of Dubai-based financial services firm Optasia and Africa telecommunications venture Channel IT. Now, he is exploring a move to either Monaco or Greece. “I would like to do anything possible if we could stay, but it’s about preservation of wealth for the future generation, and we cannot put that at risk.”

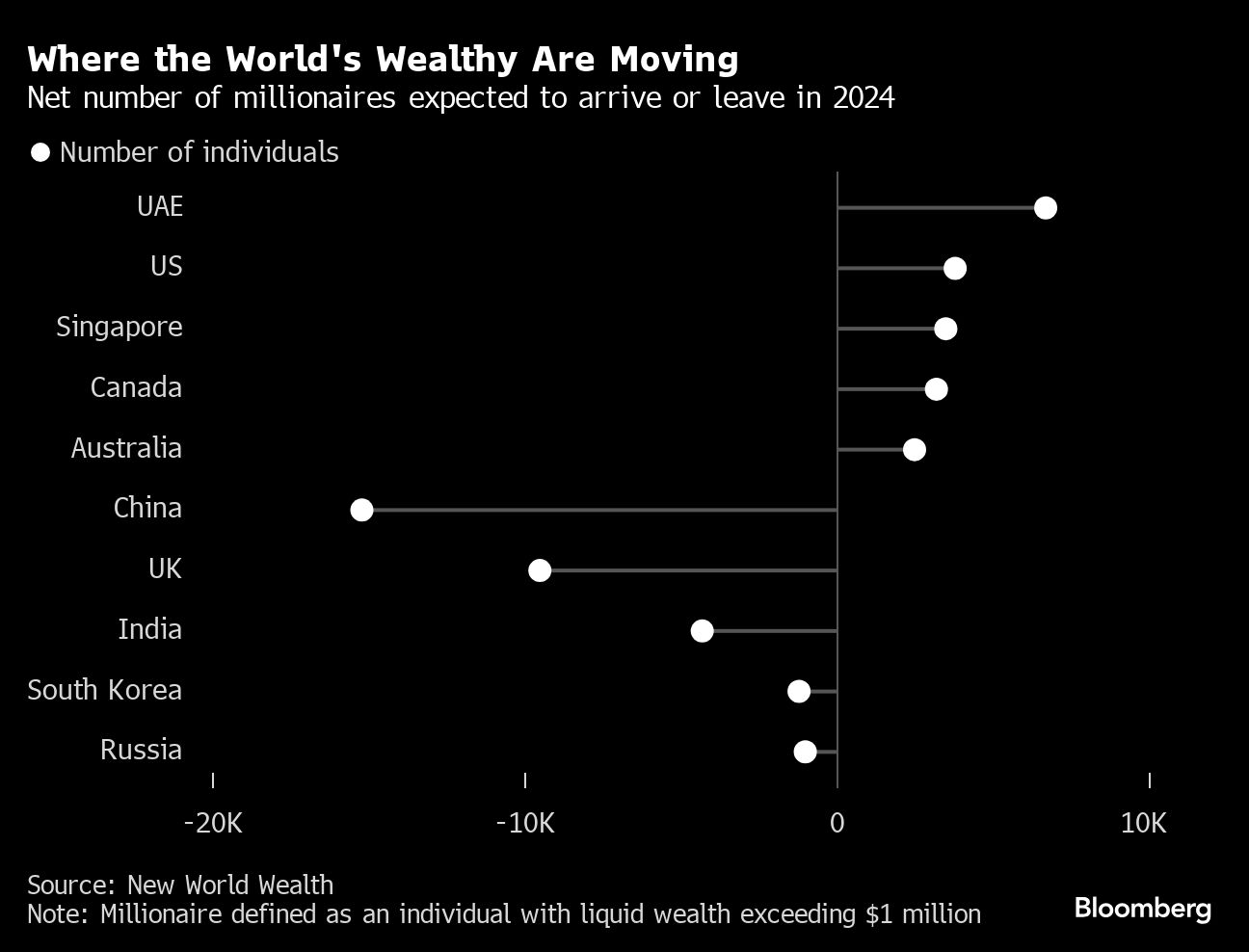

Britain’s non-dom turmoil partly highlights why the nation is facing an exodus of millionaires this year with UK nationals even seeking to move overseas as taxes remain at postwar highs.

While Britain still remains a global wealth hub, unfavorable measures over the past decade or so — including taxes on companies owning residences and luxury goods, along with the introduction of major reforms to the existing non-dom regime — have undermined that status.

Read More:What Is ‘Non-Dom’ Status and Why Is UK Scrapping It? QuickTake China and Britain Face an Exodus of Millionaires, Study Shows Carried Interest Fears Have UK Private Equity Execs Eyeing Milan |

Britain’s reputation for legal and political stability has also been rocked by the upheaval caused by Brexit and the chop-and-change of five different Tory prime ministers since 2016. Meanwhile, other European territories like Italy and Greece have rolled out their own programs to lure wealthy foreigners after the UK already lost high-profile, ultra-high-net worth individuals to long-standing hotspots for the super-rich.

“There’s a wealth drain,” added Haidar, citing almost a dozen peers who have exited the UK in recent months to territories including Madrid, Dubai and Monaco. “It’s very sad.”

Non-dom status dates back to 1799, when it was introduced to protect colonial investments. Under the current program, non-domiciled residents — ranging from multibillionaires to middle-ranking bankers — don’t pay UK taxes on their overseas earnings for as long as 15 years. They can initially claim the status without any extra charges, but eventually face annual costs of as much as £60,000 ($76,680) if they continue to reside in Britain.

Recent notable non-doms include HSBC Holdings Plc’s former boss Stuart Gulliver and onetime deputy chairman of the Conservative Party, Michael Ashcroft.

Akshata Murty, the wife of former PM Rishi Sunak, was also revealed in 2022 to benefit from the status. After a media storm, Murty said she would pay UK taxes on her global earnings, partly derived from the shares she holds in Indian software giant Infosys Ltd.

The number of non-doms is already declining, falling by almost half to 68,800 in the decade to 2022, partly from a 2017 change to the rules that stopped individuals using the benefit permanently. Still, those retaining the status pay more than £8 billion in British taxes a year, according to latest official data.

German psychedelics and crypto investor Christian Angermayer is among the UK’s current non-dom population. He lives in a penthouse apartment in London and employs more than a dozen staff to help manage his wealth in the city through his family office, Apeiron Investment Group. After becoming disillusioned with life in the British capital, he now intends to leave.

“It’s not the business center of the world anymore,” he said, declining to disclose where he plans to relocate. The latest non-dom reform “is a bigger disaster for the government than Brexit,” he said.

Read more:End of UK’s Non-Dom Tax Break Unsettles Wealthiest Residents World’s Rich Caught in Crossfire of Britain’s Election Battle Britain’s Rich Fret Over Labour’s Keir Starmer Winning Power |

Labour leaders have previously estimated they can raise about £3 billion from scrapping the UK’s non-dom regime and making those claiming the status pay local taxes on their overseas income and earnings. That echoes recent academic research that predicted fewer than 100 wealthy foreigners with the status would subsequently leave the nation.

Yet one City of London law firm alone had already received queries relating to non-dom changes from people ranging from multibillionaires to centi-millionaires numbering at least roughly half that total by the start of last month, Bloomberg News reported previously. Some of them have already left.

In response to her reelection, Rachel Reeves — who became Chancellor of the Exchequer in Prime Minister Starmer’s new Labour government on Friday — said in a post on X: “You’ve put your trust in me. And I will not let you down.”

Reeves “is going to soon discover that there are actually fewer cookies than predicted in the non-dom jar,” said David Lesperance, a Poland-based tax and immigration adviser to the ultra-rich. “My clients are operating on the assumption that they only have 10 minutes to pack their bags.”

To be sure, some non-doms are staying for now as it’s likely the rule changes won’t come in until next year at the earliest, according to Mark Davies, a tax adviser to the super-wealthy. That gives Labour time to engage with the remaining non-dom population and explore a balancing act. The current regime, for example, allows those claiming the status to bring offshore funds into the UK without incurring tax charges if they meet criteria for investing into parts of the local economy.

“We might not have a mass exodus,” Davies said. But “some are not waiting.”

Following the UK’s previous general election in 2019, Labour have made a concerted push under Starmer and Reeves to engage with Britain’s business community and distance themselves from former firebrand leader Jeremy Corbyn, even as they seek to increase taxes for private school fees and private equity earnings.

Those outreach efforts have prompted UK billionaires including Jim Ratcliffe and John Caudwell to voice their support for Labour, which has been out of power for 14 years. But those attempts haven’t been enough so far to convince Haidar to remain in the country where he first settled with his family as a non-dom in 2010.

The married entrepreneur, who has adult children, originally chose the UK over Switzerland and Monaco for reasons ranging from Britain’s strong schooling system to his preference for an English-speaking territory. He’s since accumulated what he estimates to be a £100 million property portfolio and spent time outside the nation following the 2017 non-dom reforms to reset the time-limit on him claiming the status.

Haidar, a Conservative Party donor, has put a transaction to acquire a central London property on hold as he waits to see what legislation the Labour Party puts forward on non-doms before making a final decision on whether to relocate overseas later this year.

If he exits, there’s no going back.

“The train would’ve left the station by then,” he said. “Once it moves, that’s it.”

Read More:Billionaire Tory Donor Says UK Tax Cut Was ‘Stark Raving Mad’ UK Labour Vows to Scrap Non-Dom Tax Status Held by Sunak Wife |

--With assistance from Mark Bergen, Gaspard Sebag, Anthony Cormier, Charlie Wells and Asad Zulfiqar.

(Updates with Reeves becoming the Chancellor in 18th paragraph.)

Most Read from Bloomberg

- Kamala Harris Is Having a Surprise Resurgence as Biden’s Campaign Unravels

- Stocks Up as Path to September Fed Cut Gets Wider: Markets Wrap

- Singapore Couples Are Marrying Earlier to Buy Homes, Leading Some to Regret

- Biden Digs In, Declares He Is Staying in Presidential Race

- Singapore Is Making Life Tougher for Global Talent

©2024 Bloomberg L.P.

2024-07-05T10:41:31Z dg43tfdfdgfd